The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit. A thorough https://www.bookstime.com/ accounting system and a well-maintained general ledger helps assess your company’s financial health accurately. There are many more formulas that you can use, but the eight covered in this article are undoubtedly key for a profitable business. There are many more formulas that you can use, but the 8 covered in this article are undoubtedly key for a profitable business.

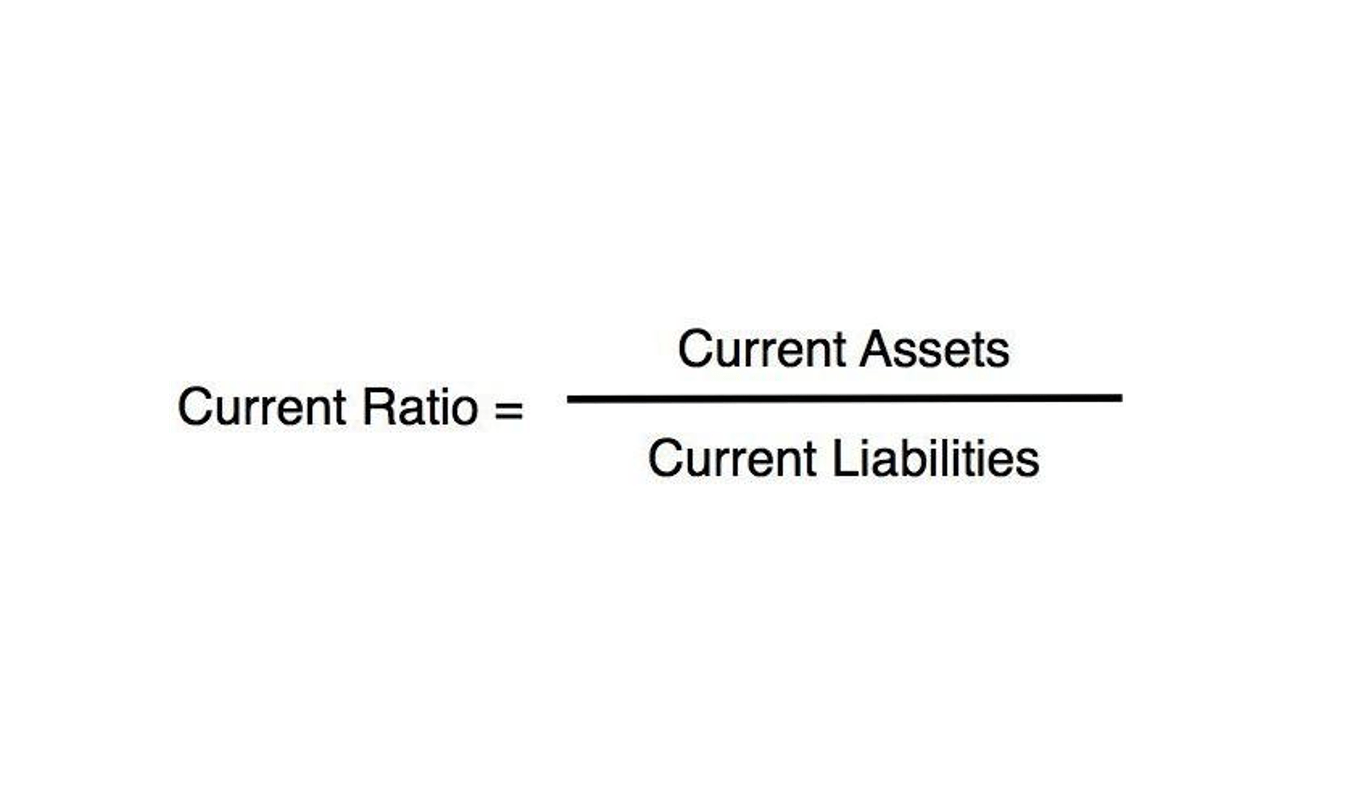

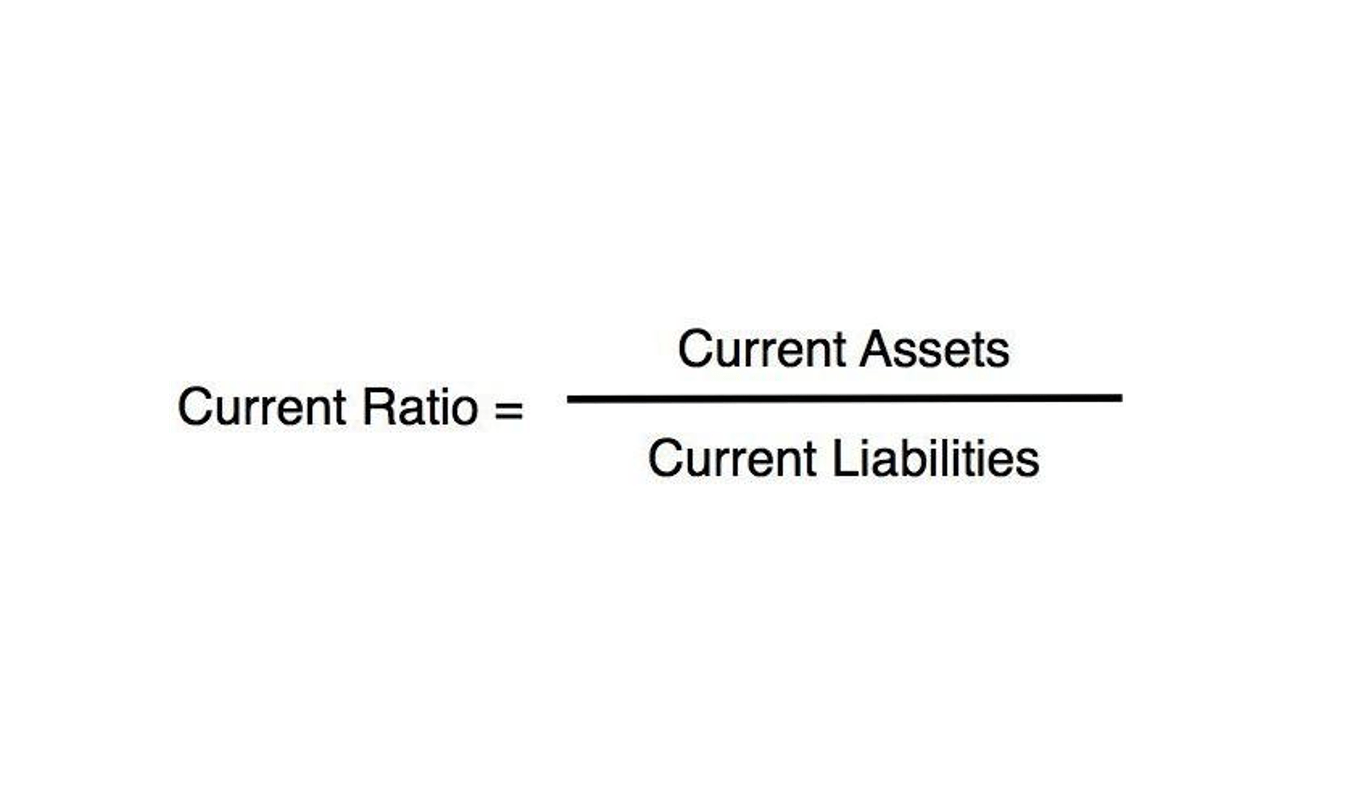

There are a variety of accounting formulas for businesses that can be used for a variety of purposes, such as producing a statement of cash flows, reviewing inventory turnover and analysing total sales. Below are some of the most common accounting equations businesses should know. On your balance sheet, these 3 components will show how your business is financially operating. This makes our list of important accounting formulas because once you understand it, you can see at a glance how healthy your business is. For example, let’s say the balance of your bank accounts, plus your other assets (like computers, furniture, etc.) and your accounts receivable total $15,000.

Accounting Principles: Basic Definitions, Why They’re Important

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. We believe everyone should be able to make financial decisions with confidence. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.

If you have high sales revenue but still have a low profit margin, it might be a high time to take a look at the figures making up your net income. To assess the functioning of a small business or even a large one, there is a set of specific accounting equation formulas that is most handy. They can be used as first-hand solutions to derive a conclusion accounting equation depending on the business needs. As you can tell, anything you can do to increase your gross profit increases your gross profit margin. And increasing your gross profit margin has a direct impact on your net income. Increasing your gross profit margin by decreasing cost of sales lets you grow your business’ profitability without increasing sales.

Accounting formulas for businesses

Use our product selector to find the best accounting software for you. Hence, it is crucial to understand all these terms before delving deeper into the topics of accounting. You must have a holistic understanding of all these to strengthen your foundation so that you can navigate through the advanced topics more conveniently. Costs or expenses that differ based on the sales volume or productivity of business are variable. Regular expenses that are incurred in a business to keep it functioning despite the productivity level, such as building rent and warehouse maintenance. The cash inflows to a company or business are considered under revenue.