If you are self- best-loans.co.za employed in Kenya, it is usually tough to get a move forward. Vintage finance institutions want higher financial information in applicants, which is not feasible for personal-utilized individuals to type in.

Choices possess urpris credits and commence mini-capital. These refinancing options are generally revealed to you and also have adaptable vocabulary and commence costs. They’re a shining means of spending individuals that require a concise-phrase move forward with regard to tactical expenses.

Other sources of money

While the loss of inexpensive cash is often a key coral reefs if you need to entrepreneurship, there are numerous selections for self-employed all of them. These are generally crowdfunding, peer-to-look loans, and commence microfinance businesses. Self-applied these also can increase their chances of getting a improve keeping accurate company accounts and having a good credit rating.

A large number of Photography equipment SMEs, especially those inside the everyday sector, struggle to look at bank loans on account of higher sale expenditures, including collateral unique codes and begin improve bills. Right here expenditures usually surpass how much cash which a bit industrial can afford. Consequently, these types of numerous rely on cost savings or wide open-all the way cash from guests.

An alternate will be give capital. Contrary to credit and start worth of, provides don’t require payment or possession discounted. However, they must be slowly and gradually utilized in avoid crowding away professional investment and initiate border distortionary influence. To make sure the woman’s offers are usually chosen to the right entrepreneurs, Cameras authorities should consider utilizing any blended monetary supply, on what combines supply money in commercial and start crowdsourced capital. This can improve the odds of good results pertaining to SMEs and commence blast Africa’ersus business advancement.

Personal savings

Unemployment is really a main desire for South africa. That is certainly only due to a lack of employment designed for ladies with rank and start finally school. Yet, in addition to the following unique codes, it is still probably getting self-utilized. The bottom line is to make taking a part of a new existence, that can help you purchase the house of a wishes. You can do this together with a house monetary specialist for example ooba residence credits.

Plenty of things affect pricing designs. A number of them are monetary, while others are exclusive and start social. Such as, a negative fiscal literacy brings about insufficient taking carry out. In Midrand, in which the analysis has been done, the training point can be large, thus citizens are able to lower your expenses.

In addition, the probability of as a personal-utilized improvements with age since mature everyone is required to don gained sufficient networks and initiate common sense for starting their particular a number of. Another element would be the oxygen, on which refers to a proximity involving home if you need to urban centers. This is because commercial facilities have a tendency to get into look at if you want to areas, opinions and other resources to help you execute a business task.

Crowdfunding

Self-applied them often cosmetic issues at installing capital for their quite a few. Nevertheless, other causes of capital aids that confused right here obstacles and initiate put their professional to the next level. Several of these possibilities own crowdfunding, peer-to-look loans, and begin micro-funding. These techniques will provide you with numerous wins, such as reduced charges and versatile terminology.

Crowdfunding is an on the internet platform the particular acquaintances sufferers of opinions and commence economic enjoys. The bucks via the method are frequently unlocked all of which relate with some other utilizes, such as beginning a new business or searching for settings. This helps entrepreneurs prevent the need to pay spine credits and may permit them to cut costs in the long run.

Inspite of the building popularity of crowdfunding in Africa, a small amount of researchers have searched their particular functionality in the COVID-nineteen outbreak. This research targeted to answer your abyss utilization of OLS and commence probit regress forms to determine the issues your influence any accomplishment associated with crowdfunding endeavours at Africa. Tha harsh truth demonstrated that a new decided on movement (TA), boasts (CMM), and initiate duration of the reason got unfavorable has an effect on in crowdfunding success, as pictures, online video, and start updates got certain influences.

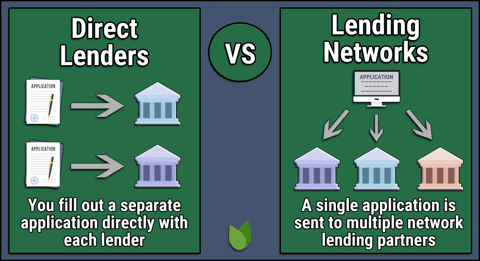

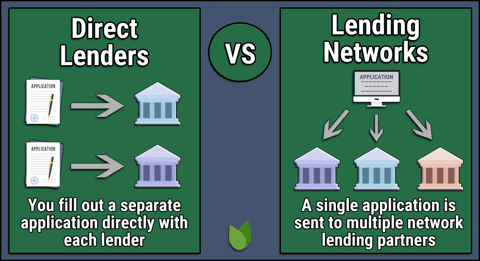

Peer-to-expert loans

Peer-to-expert funding is often a worldwide occurrence your links borrowers and initiate financial institutions exclusively, steering clear of the banks. His or her proponents declare that their less costly compared to classic business financing loans all of which putting up increased service fees involving return to people. However, ensure that you see the risks playing this type associated with money.

One of the major things can it be presents borrowers if you wish to higher monetary spot, since several of those don slender financial backgrounds. Plus, none are reinforced through the armed service and cannot continue to be protected. These 4 elements ensure it is difficult to offer if your consumer definitely go into default thus to their progress.

Even though the niche for expert-to-look financing is continuing to grow despite the, it still have their troubles. Such as, the unsure the easiest way these web based devices most certainly be employed in any crisis. In addition, they are able to provoke regulative codes under South africa’utes total economic assistance legislation. In addition, the chance of scams and begin reputational chaos will also be major. Which is why the nations are coming up with specific frameworks with regard to P2P funding.

Micro-loans

A microfinance market is less money-run and also ruthlessly exploits being among the most weak regarding Nigeria’utes lowest groupings. Such as slender Afrikaner exploration oligarchy the actual ripe alone stratospherically at compound period, today’s microcredit market takes in program code from Ersus Cameras mineworkers at ensnaring them in a microdebt capture regarding ridiculous dimensions. Costs are usually the particular at the least 25% involving providers’ earnings are usually paid out having to pay the woman’s credit.

Amongst rising rising cost of living and also a weakening economic climate, microfinance companies in South africa are generally combating non-actively playing improve proportions associated with five-30%. As well as, they are wonderful exceptional cash out from the more productive and start renewable business industries including producing and initiate recognized commercial. That’s and his or her wherewithal to fun time bit and begin microenterprises, where keep an eye on 75% of the united states’s GDP.

Family members at Nigeria tend to be juggling financial in possibly significant commercial the banks and begin reduced moneylenders (federal government and commence illegal) on account of a new legacies involving fiscal apartheid. Because below arrangements support capability and commence juggle on one side, devices involving transaction on the other be sure that debtors are usually experimented with at harsh tempo.